S&P 500 On Robinhood: The Ultimate Guide For Everyday Investors

So, you’ve probably heard about the S&P 500 and Robinhood, right? Like, these two terms are kinda big in the investing world. The S&P 500 is this massive index that tracks the performance of 500 of the biggest companies in the U.S., while Robinhood is this cool app where you can trade stocks without paying those pesky fees. Imagine being able to access the cream of the crop in the stock market right from your phone? Yeah, that’s what we’re talking about here. If you’re thinking about dipping your toes into the world of investing, this article is your golden ticket to understanding how the S&P 500 works on Robinhood.

Now, let’s break it down for you. The S&P 500 isn’t just some random list of companies; it’s like the A-list of the stock market. These are the big players, the ones that everyone’s watching. And Robinhood? It’s like the ultimate platform for newbie investors who want to get in the game without breaking the bank. In this guide, we’ll dive deep into how you can invest in the S&P 500 through Robinhood, what to expect, and how to make the most out of your investments. So, grab a coffee, sit back, and let’s get started!

Before we jump into the nitty-gritty, it’s important to know that investing in the S&P 500 via Robinhood isn’t just about picking stocks and hoping for the best. There’s a whole lot more to it, from understanding the market trends to knowing when to buy and sell. This guide is here to help you navigate that journey, making sure you’re armed with the knowledge and tools you need to succeed. So, are you ready to level up your investing game?

- Is The Mountain Out Today A Pacific Northwest Phenomenon You Need To Know

- Elvira Maestre The Iconic Voice Of Spainrsquos Tv History

Table of Contents

- What is the S&P 500?

- Robinhood: The App Changing Investing

- How to Invest in the S&P 500 on Robinhood

- Benefits of Investing in the S&P 500

- Understanding the Risks

- Strategies for S&P 500 Investing

- Robinhood Fees and Charges

- Common Mistakes to Avoid

- Tips for Success

- Conclusion: Start Your Journey Today

What is the S&P 500?

Alright, let’s start with the basics. The S&P 500, or Standard & Poor’s 500 Index, is this super important benchmark in the world of finance. It represents the stock performance of 500 of the largest publicly traded companies in the U.S. Think of it like a report card for the overall health of the U.S. economy. If the S&P 500 is doing well, chances are the economy is too. And vice versa.

Why is the S&P 500 Important?

Here’s the thing: the S&P 500 isn’t just some random list of companies. It’s carefully selected to represent different sectors of the economy, from tech giants like Apple and Microsoft to consumer goods companies like Procter & Gamble. This diversification is what makes the S&P 500 such a reliable indicator of market trends. Plus, it’s one of the most widely followed indexes in the world, so you know it’s legit.

- Revolutionizing Your Ride Why Pods Automotive Is The Future Of Driving

- Boruto Blue Vortex The Ultimate Guide For Every Fan

How Does the S&P 500 Work?

Now, the S&P 500 is a market-capitalization-weighted index, which means that the companies with the highest market caps have the biggest influence on its performance. For example, if Apple has a massive quarter, it’s going to have a noticeable impact on the overall index. But don’t worry if that sounds complicated—we’ll break it down further as we go along.

Robinhood: The App Changing Investing

Okay, so now that we’ve got the S&P 500 down, let’s talk about Robinhood. This app has been a game-changer for retail investors, especially those who are just starting out. Gone are the days of paying hefty brokerage fees every time you want to make a trade. Robinhood offers commission-free trading, which means you can buy and sell stocks without worrying about those extra costs.

What Makes Robinhood Unique?

Well, for starters, it’s super user-friendly. Even if you’ve never traded before, Robinhood’s interface is so intuitive that you’ll be up and running in no time. Plus, it offers a range of features like fractional shares, which allow you to invest in stocks even if you don’t have the full price of a single share. And let’s not forget about the community aspect—Robinhood users can share tips and insights, making it a collaborative platform for learning and growing.

Is Robinhood Safe?

Yeah, we get it. Safety is a big concern, especially when you’re dealing with your hard-earned money. But here’s the deal: Robinhood is regulated by the SEC and FINRA, so you know it’s legit. Your funds are also protected by SIPC insurance, which covers up to $500,000 in securities and $250,000 in cash. So, yeah, it’s pretty safe.

How to Invest in the S&P 500 on Robinhood

So, you’re ready to invest in the S&P 500 through Robinhood? Great! Here’s a step-by-step guide to help you get started:

Step 1: Sign Up for Robinhood

First things first, you’ll need to download the Robinhood app and create an account. It’s pretty straightforward—just enter your personal info and link your bank account. Don’t worry, they’ll walk you through the process.

Step 2: Fund Your Account

Once you’ve set up your account, it’s time to add some funds. You can transfer money directly from your bank account or use a debit card. Just keep in mind that there might be limits on how much you can deposit at once.

Step 3: Find an S&P 500 ETF

Now, here’s where things get interesting. You can’t directly invest in the S&P 500 itself, but you can invest in exchange-traded funds (ETFs) that track its performance. Some popular options include:

- SPY (SPDR S&P 500 ETF Trust)

- VOO (Vanguard S&P 500 ETF)

- IVV (iShares Core S&P 500 ETF)

These ETFs give you exposure to the entire S&P 500, so you’re essentially investing in all 500 companies at once. Cool, right?

Step 4: Place Your Order

Once you’ve picked your ETF, it’s time to place your order. You can choose between a market order (buy at the current price) or a limit order (buy only if the price reaches your desired level). And that’s it! You’re now an investor in the S&P 500.

Benefits of Investing in the S&P 500

Alright, so why should you invest in the S&P 500? Here are a few reasons:

1. Diversification

As we mentioned earlier, the S&P 500 includes companies from a wide range of sectors. This diversification helps reduce risk, as your investments aren’t tied to the performance of a single company or industry.

2. Historical Performance

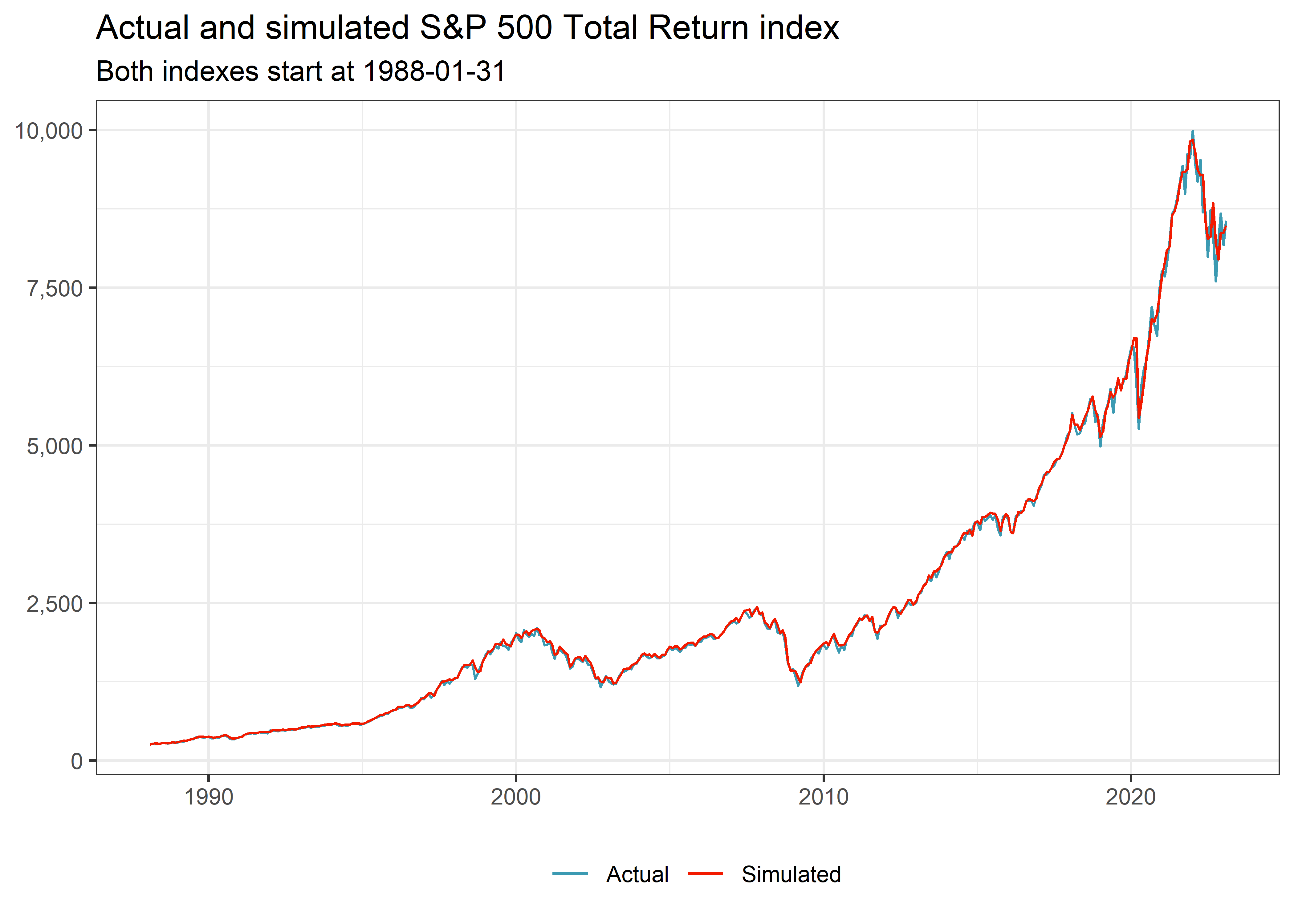

The S&P 500 has a solid track record of delivering strong returns over the long term. Over the past 90 years, it’s averaged an annual return of about 10%. Of course, past performance doesn’t guarantee future results, but it’s a good indicator of what you might expect.

3. Liquidity

Because the S&P 500 is so widely followed, the ETFs that track it are highly liquid. This means you can buy and sell shares easily without worrying about finding a buyer or seller.

Understanding the Risks

Now, before you dive headfirst into the S&P 500, it’s important to understand the risks involved:

1. Market Volatility

Stock markets can be unpredictable, and the S&P 500 is no exception. Prices can fluctuate wildly in response to economic news, geopolitical events, and other factors. So, you need to be prepared for some ups and downs.

2. Inflation

Inflation can erode the purchasing power of your investments over time. While the S&P 500 has historically outpaced inflation, there’s no guarantee that it will continue to do so in the future.

3. Fees

While Robinhood doesn’t charge commission fees, the ETFs you invest in may have management fees. These are usually pretty low, but it’s something to keep in mind.

Strategies for S&P 500 Investing

Okay, so you know the basics. But how do you actually make the most out of your S&P 500 investments? Here are a few strategies:

1. Dollar-Cost Averaging

This is a great way to reduce the impact of market volatility. Instead of investing a lump sum all at once, you invest a fixed amount at regular intervals, like every month or quarter. This way, you’re buying more shares when prices are low and fewer shares when prices are high.

2. Long-Term Investing

The S&P 500 is a great option for long-term investors. By holding onto your investments for several years, you give them time to grow and recover from any short-term fluctuations.

3. Reinvest Dividends

Many of the companies in the S&P 500 pay dividends, which are distributions of profits to shareholders. By reinvesting these dividends, you can accelerate the growth of your portfolio over time.

Robinhood Fees and Charges

Let’s talk about fees for a moment. One of the biggest selling points of Robinhood is that it doesn’t charge commission fees. However, there are a few other fees you should be aware of:

1. Management Fees

As we mentioned earlier, the ETFs you invest in may have management fees. These are usually pretty low, ranging from 0.03% to 0.10% per year.

2. Robinhood Gold

If you want access to more advanced features, like margin trading, you’ll need to upgrade to Robinhood Gold. This service costs $5 per month, plus interest on any borrowed funds.

3. Withdrawal Fees

There’s no fee for withdrawing funds from your Robinhood account, but it can take a few days for the money to arrive in your bank account.

Common Mistakes to Avoid

Alright, let’s talk about some common mistakes that new investors make:

1. Trying to Time the Market

Trying to predict when the market will go up or down is almost impossible. Instead of trying to time the market, focus on long-term strategies like dollar-cost averaging.

2. Overtrading

Trading too frequently can lead to poor decision-making and missed opportunities. Stick to a solid investment plan and avoid the temptation to make impulsive trades.

3. Ignoring Fees

Even small fees can add up over time, so it’s important to be aware of them. Make sure you understand all the fees associated with your investments before you start trading.

Tips for Success

Here are a few tips to help you succeed in your S&P 500 investing journey:

1. Educate Yourself

Detail Author:

- Name : Zechariah Schroeder

- Username : ottilie.heller

- Email : dereck.kohler@hotmail.com

- Birthdate : 1993-12-15

- Address : 459 Mueller Field East Jonland, IN 79177

- Phone : +1 (567) 587-8769

- Company : Abbott-Ernser

- Job : Packer and Packager

- Bio : Consequatur quia amet voluptatum omnis molestiae. Similique et reiciendis officia nisi vel est aperiam unde. Inventore pariatur et voluptate repellat molestiae. Sed delectus amet hic dolorem.

Socials

linkedin:

- url : https://linkedin.com/in/damian.greenfelder

- username : damian.greenfelder

- bio : Aliquid atque est numquam qui quia nihil.

- followers : 5118

- following : 262

twitter:

- url : https://twitter.com/dgreenfelder

- username : dgreenfelder

- bio : Qui iure nihil et voluptatem ut tempore. Voluptatem velit quas fuga facere. Repudiandae maxime ullam tenetur.

- followers : 3625

- following : 2800

facebook:

- url : https://facebook.com/damian_greenfelder

- username : damian_greenfelder

- bio : Totam quis veniam quam ut hic dicta libero.

- followers : 1273

- following : 2384

instagram:

- url : https://instagram.com/damian_greenfelder

- username : damian_greenfelder

- bio : Enim et dolor dolorum est. Nisi facilis dolore sunt.

- followers : 6250

- following : 2093

tiktok:

- url : https://tiktok.com/@damian_dev

- username : damian_dev

- bio : Aut quia dolorem exercitationem enim natus consectetur minima.

- followers : 6657

- following : 1660